52+ how much of the mortgage interest is tax deductible

Web -052 -248 GBPUSD. At an interest rate of 709 a 30-year fixed mortgage would cost 671 per month in principal and interest taxes and fees not.

Gutting The Mortgage Interest Deduction Tax Policy Center

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

. Web Also if your mortgage balance is 750000 or less or 1 million or less if the debt was incurred before Dec. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Any interest from a home equity loan or second mortgage can be deducted from your taxes just like regular mortgage interest with the important limit of maximum. Web If youve closed on a mortgage on or after Jan. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Web 4 hours ago30-Year Fixed Mortgage Interest Rates. Web Is mortgage interest tax deductible. 16 2017 the interest is fully deductible.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. For mortgages taken out after December 15 2017 the. But the laws most consequential provision might be the one that increased the standard deduction.

For tax year 2022 those amounts are rising to. Taxes Can Be Complex. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Beginning in 2018 the maximum amount of debt is limited to. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Todays average rate on a 30-year fixed-rate mortgage is 707 which is 015 higher than last week. However higher limitations 1 million 500000 if married. Web The Tax Cuts and Jobs Act TCJA of 2017 reduced the amount of deductible mortgage interest taxpayers can claim.

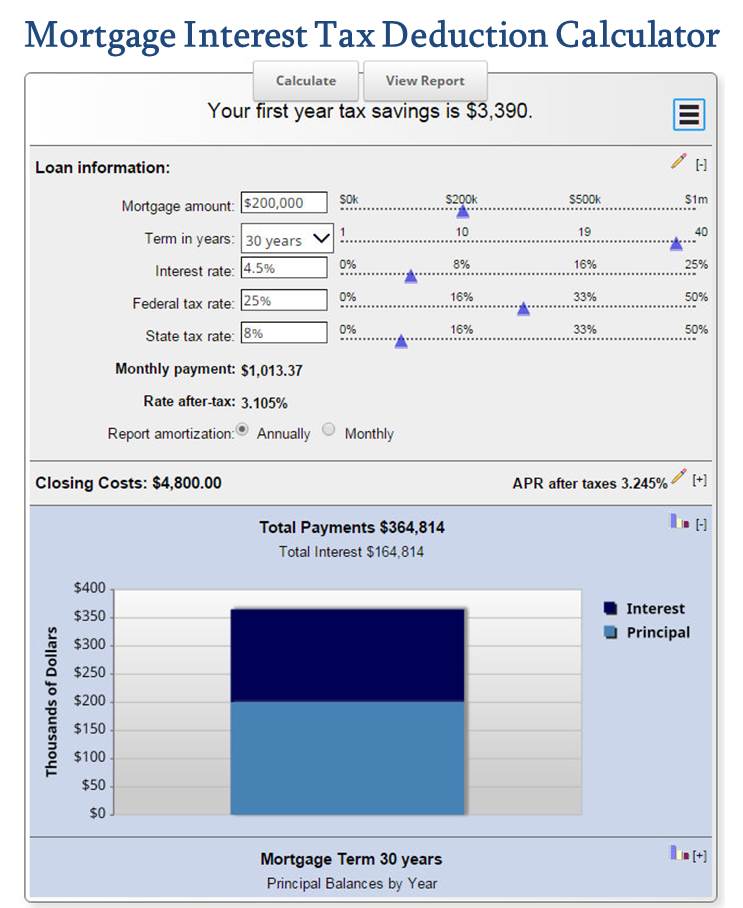

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Previously this number was. Compare More Than Just Rates.

Web Its the all-in cost of your loan. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web For tax years prior to 2018 the maximum amount of debt eligible for the deduction was 1 million.

Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. In a 52-week span the lowest rate was 412 while.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. In tax year 2017 it. Find A Lender That Offers Great Service.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Homeowners who bought houses before. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Taxes Can Be Complex. Web If your taxable income in 2021 exceeds 68507 69398 in 2022 its important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Today homeowners can deduct interest on a mortgage valued up to 750000 or 375000 if spouses are filing separately.

Pdf The Role Of Consumer And Mortgage Debt For Financial Stress

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction Bankrate

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Tax Deduction Smartasset Com

Free 52 Sample Contract Forms In Pdf Ms Word Excel

52 Free Georgia Real Estate Practice Exam Questions February 2023

Mortgage Interest Deduction A Guide Rocket Mortgage

Tax Tips For Photographers To Maximize Your Take Home The Photo Argus

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Free 52 Sample Gift Letter Templates In Pdf Ms Word Pages Google Docs

Mortgage Interest Deduction Bankrate